Index Options

受取状況を読み込めませんでした

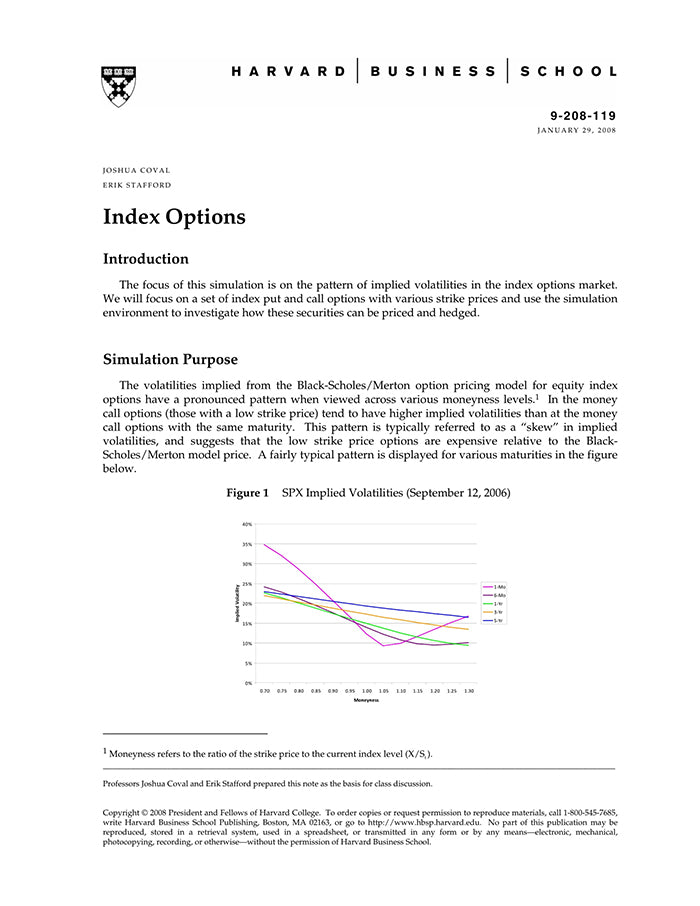

The goal of this simulation is to understand the patterns in index option prices that are not predicted by the Black-Scholes model. In particular, the simulation focuses on two properties of options prices. First, at-the-money implied volatilities from index options tend to be larger than the realized volatility. Second, the implied volatilities from index options are increasing as the strike price falls, relative to the current index level (i.e. out-of-the-month call options have larger implied volatilities than at-the-money call options). Students are given a dataset of relevant market information to analyze. From these materials, students are expected to develop an investment strategy that attempts to deliver low risk profits from the index options market. The actual simulation is fairly short and simple. Students trade 1-month put and call options on the S&P 500 (SPX) at three different strike prices (10% out-of-the-money, at-the-money, and 10% in-the-money). The simulation covers five months of calendar time (5 sets of options) in about 35 minutes.

【書誌情報】

ページ数:3ページ

サイズ:A4

商品番号:HBSP-208119

発行日:2008/1/29

登録日:2009/12/11