Duration and Convexity

通常価格

¥1,144 JPY

通常価格

セール価格

¥1,144 JPY

単価

あたり

税込み。

受取状況を読み込めませんでした

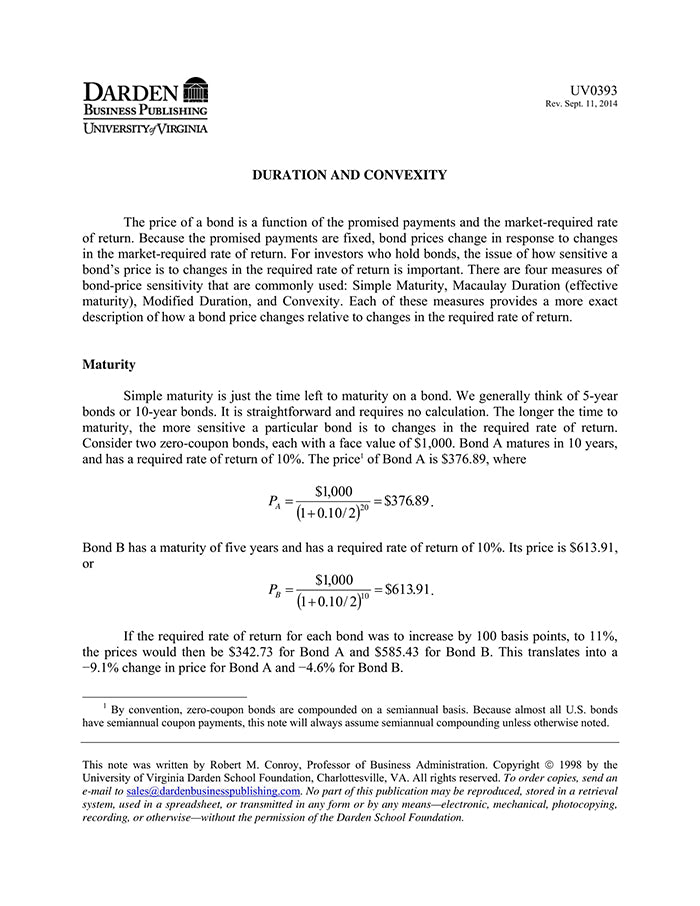

The price of a bond is a function of the promised payments and the market-required rate of return. Because the promised payments are fixed, bond prices change in response to changes in the market-required rate of return. For investors who hold bonds, the issue of how sensitive a bond's price is to changes in the required rate of return is important. There are four measures of bond-price sensitivity that are commonly used: Simple Maturity, Macaulay Duration (effective maturity), Modified Duration, and Convexity. Each of these measures provides a more exact description of how a bond price changes relative to changes in the required rate of return.

【書誌情報】

ページ数:9ページ

サイズ:A4

商品番号:HBSP-UV0393

発行日:1999/8/19

登録日:2015/2/5