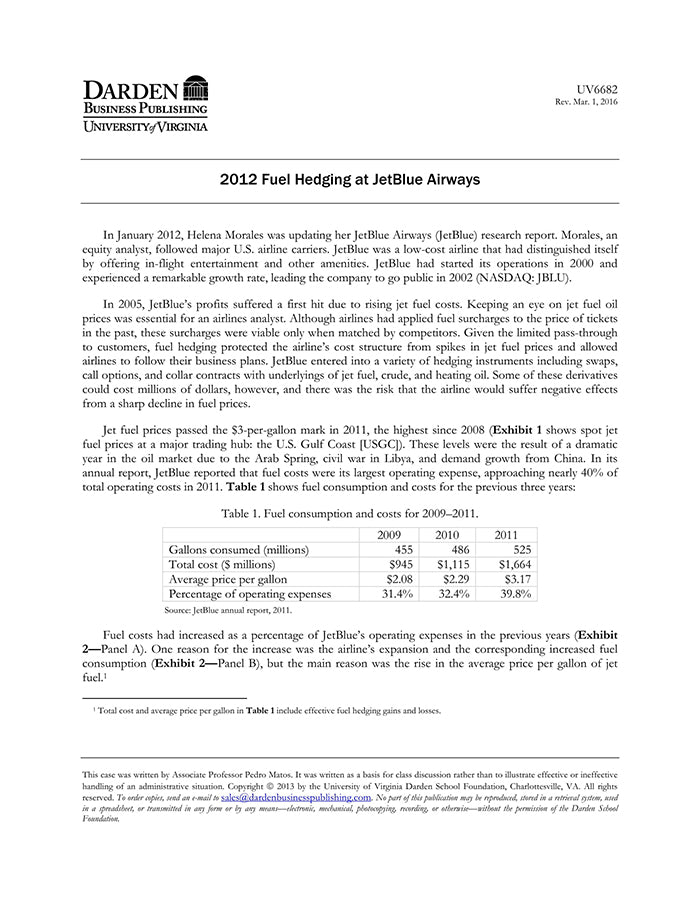

2012 Fuel Hedging at JetBlue Airways

受取状況を読み込めませんでした

At the start of 2012, Helena Morales, an equity analyst, was examining the jet fuel hedging strategy of JetBlue Airways for the coming year. Airlines cross-hedged their jet fuel price risk using derivatives contracts on other oil products such as WTI and Brent crude oil. Consequently, an airline was exposed to basis risk. In 2011, dislocations in the oil market led to a Brent-WTI premium wherein jet fuel started to move with Brent instead of WTI, as it traditionally did. Faced with hedging losses, several U.S. airlines started to change their hedging strategies, moving away from WTI. But others worried that the Brent-WTI premium might be a temporary phenomenon. For 2012, would JetBlue continue using WTI for its hedges, or would it switch to an alternative such as Brent?

【書誌情報】

ページ数:23ページ

サイズ:A4

商品番号:HBSP-UV6682

発行日:2013/6/21

登録日:2013/9/12